Will Q2 Earnings on July 31 Power Amazon Stock Higher?

/Amazon%20pickup%20%26%20returns%20building%20by%20Bryan%20Angelo%20via%20Unsplash.jpg)

Amazon (AMZN) will announce its second-quarter earnings on Thursday, July 31. While Amazon shares have seen only modest gains so far in 2025, up about 5% year-to-date, they’ve shown impressive strength in recent months, climbing 24.9% over the last quarter. This rally reflects growing optimism about Amazon’s ability to maintain its dominance across key segments like e-commerce and cloud computing.

The recent rally has helped AMZN stock recover from earlier pullbacks, and technical indicators suggest the rally may not be over. The stock’s 14-day Relative Strength Index (RSI) stands at 63.87, which is comfortably below the 70 overbought threshold. That suggests there’s still room for upward movement if upcoming results and guidance exceed expectations.

Notably, Amazon’s fundamentals remain solid. Its core retail operations continue to perform well, and Amazon Web Services (AWS), the company’s profitable cloud division, continues to expand. At the same time, its advertising segment is gaining traction and contributing more meaningfully to the bottom line. These factors could combine to drive both top-line growth and margin improvement in the second quarter, offering a potential catalyst for the stock.

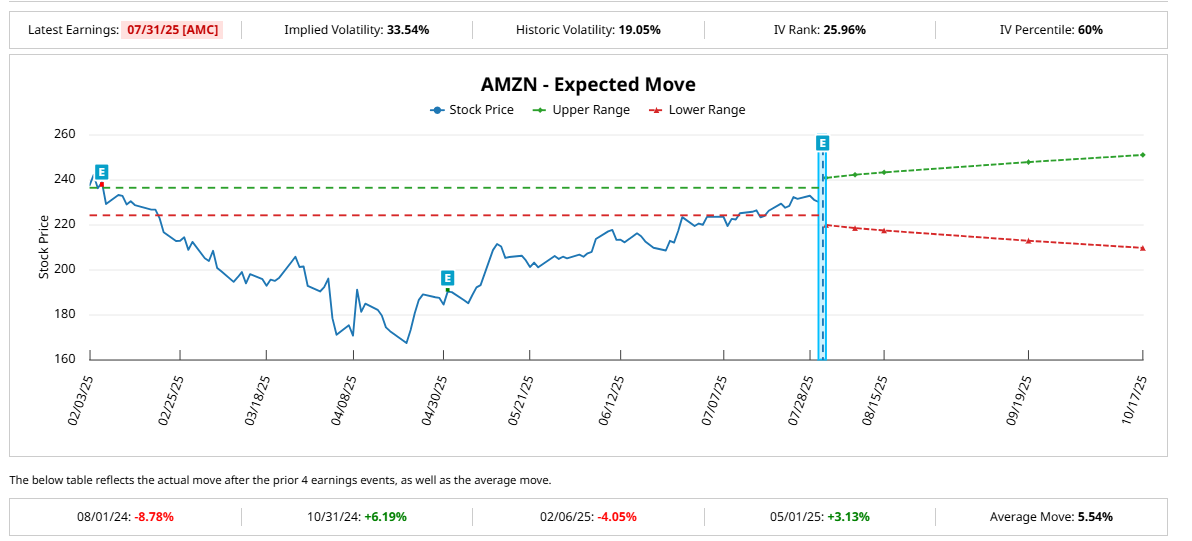

Still, not all clouds have cleared. Persistent macroeconomic headwinds could inject volatility into the stock, and the options market seems to be bracing for that possibility. Traders are currently pricing in a post-earnings move of around 4,55% in either direction.

Amazon to Deliver Steady Revenue and Earnings Growth in Q2

Amazon appears well-positioned for another quarter of solid performance, with both revenue and earnings expected to show steady growth in Q2. The company has guided for net sales between $159 billion and $164 billion, representing a year-over-year increase of 7% to 11%.

Amazon’s e-commerce business could continue to benefit from key competitive advantages such as rapid delivery, extensive product selection, and competitive pricing. Moreover, Amazon’s focus on operational efficiency will support margins in this segment. From integrating automation and robotics in its fulfillment centers to optimizing inventory management, the company is lowering delivery times and reducing packaging and shipping costs, which helps the company lower the cost to serve.

Amazon’s AWS could once gain power its growth. Notably, in Q1, AWS generated $29.3 billion in revenue, up 17% from a year earlier. The tailwinds from generative AI adoption and the continued shift from on-premises infrastructure to the cloud are still in the early innings. With Amazon’s AI offerings already delivering multibillion-dollar revenues and growing at triple-digit rates, AWS has a long runway ahead.

The segment delivered $11.5 billion in operating income in Q1, accounting for the bulk of Amazon’s total operating profit. As the company continues to fine-tune AWS operations, this high-margin business is likely to play an even greater role in boosting overall profitability.

Amazon’s advertising business is another bright spot, driving revenue and profitability. In Q1, ad revenue climbed 19% year-over-year to reach $13.9 billion. This segment is becoming increasingly central to Amazon’s growth story as brands look to engage consumers at all stages of the purchase funnel. The advertising unit is contributing meaningfully to earnings, and this trend is expected to continue in the coming quarters.

Looking ahead to Q2, analysts expect Amazon to report earnings of $1.33 per share, reflecting an 8.1% increase from the year-ago quarter. Notably, Amazon has surpassed Wall Street’s expectations in each of the past four quarters, most recently with a 17.8% earnings beat.

Here’s What Analysts Recommend for AMZN Stock

Amazon remains a compelling story of diversified growth, with strong performance across e-commerce, cloud, and advertising. As operational efficiency continues to improve and high-margin segments scale further, Amazon’s long-term fundamentals appear increasingly robust heading into the second half of the year.

Analysts are bullish and maintain a “Strong Buy” consensus rating on AMZN stock before the Q2 earnings release.

On the date of publication, Amit Singh did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.