Do Wall Street Analysts Like Starbucks Stock?

/Starbucks%20Corp_%20logo%20by-%20eyewave%20via%20iStock.jpg)

With a market cap of $105.6 billion, Starbucks Corporation (SBUX) is a global coffee roaster, marketer, and retailer known for its specialty beverages, food items, and iconic brands such as Starbucks Coffee, Teavana, and Seattle’s Best Coffee. Operating through its North America, International, and Channel Development segments, the company sells products through retail stores, licensed partners, and consumer packaged goods.

Shares of the Seattle, Washington-based company have outperformed the broader market over the past 52 weeks. SBUX stock has returned 26.3% over this time frame, while the broader S&P 500 Index ($SPX) has rallied 17.4%. However, shares of Starbucks are up 5.1% on a YTD basis, lagging behind SPX’s 8.5% gain.

Focusing more closely, the coffee chain stock has outpaced the Consumer Discretionary Select Sector SPDR Fund’s (XLY) 21.7% increase over the past 52 weeks and a marginal YTD rise.

Despite reporting better-than-expected Q3 2025 revenue of $9.5 billion on Jul. 29, Starbucks shares fell 2.2% the next day due to adjusted EPS of $0.50, missing analyst estimates. Operating margin dropped sharply by 650 basis points to 10.1%, driven by increased labor investments and a costly leadership event in Las Vegas. Additionally, same-store sales declined 2% globally and in North America, marking its sixth straight quarterly decline, raising concerns about sustained demand softness.

For the fiscal year ending in September 2025, analysts expect SBUX’s EPS to decrease 25.4% year-over-year to $2.47. The company's earnings surprise history is mixed. It beat or met the consensus estimates in two of the last four quarters while missing on two other occasions.

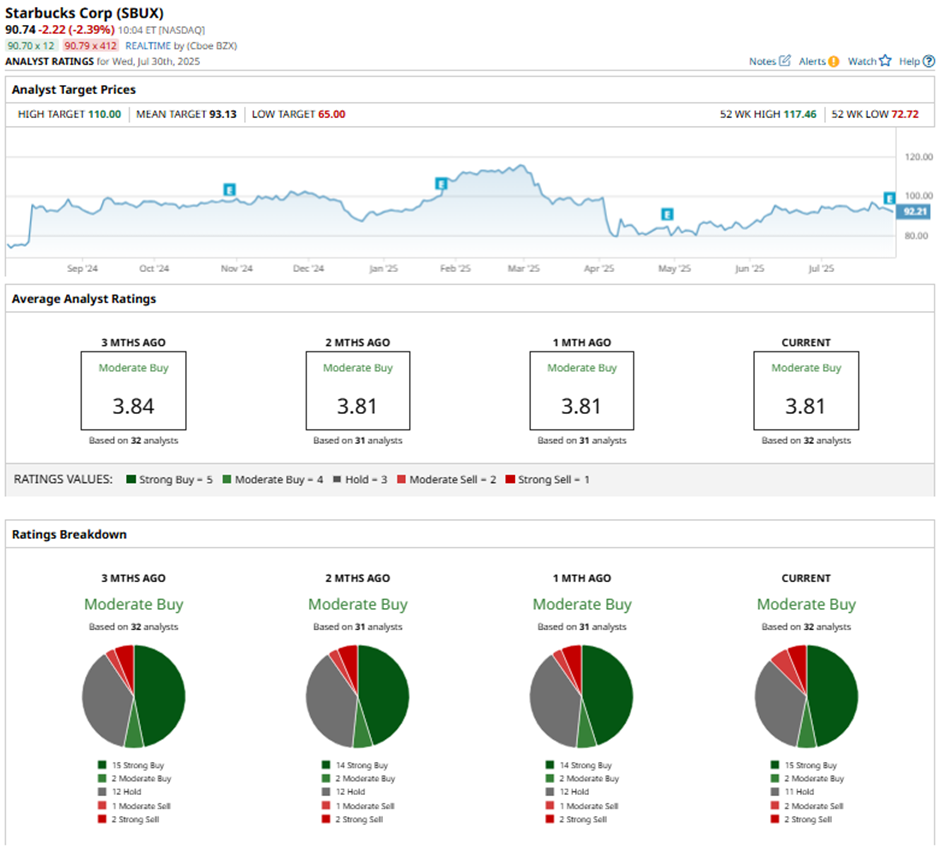

Among the 32 analysts covering the stock, the consensus rating is a “Moderate Buy.” That’s based on 15 “Strong Buy” ratings, two “Moderate Buys,” 11 “Holds,” two “Moderate Sells,” and two “Strong Sells.”

On Jun. 26, Barclays raised Starbucks' price target to $108, maintaining an “Overweight” rating.

As of writing, the stock is trading below the mean price target of $93.13. The Street-high price target of $110 implies a potential upside of 21.2% from the current price levels.

On the date of publication, Sohini Mondal did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.